Why does California’s gas tax keep increasing?

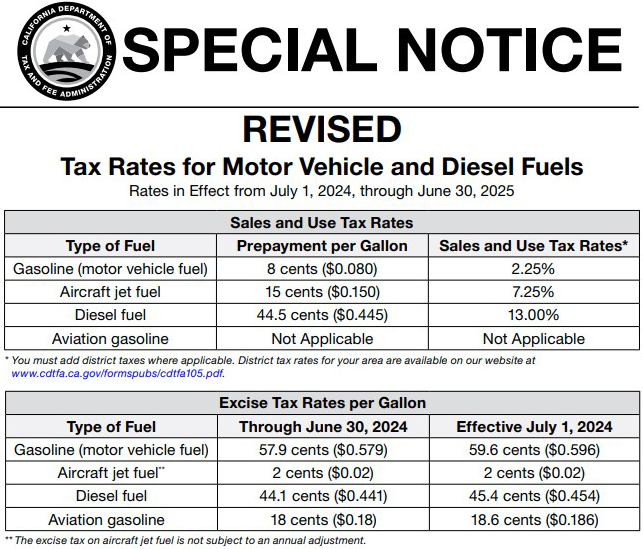

State’s excise tax on gasoline increased July 1 from 57.9 to 59.6 cents per gallon and from 44.1 to 45.4 cents per gallon for diesel fuel.

No end in the law to annual increases based on state CPI

By Allen D. Payton

If you’re not already aware, the State of California gas tax increased today, July 1, 2024 according to the announcement in May by the Department of Tax and Fee Assessment (CDTFA). According to that notice as reported by the California Taxpayers Association, the state’s excise tax* on gasoline increased today “from 57.9 cents per gallon to 59.6 cents per gallon and from 44.1 cents per gallon to 45.4 cents per gallon for diesel fuel.”

According to the California Transportation Commission, “the Legislature passed and the Governor signed SB 1 (Beall, 2017)…increasing transportation funding and instituting much-needed reforms. SB 1 provides the first significant, stable, and on-going increase in state transportation funding in more than two decades.”

Contra Costa’s representatives at that time split on the bill, with then-Assemblyman Jim Frazier, who was chairman of the Assembly Transportation Committee, and Assemblyman Tim Grayson voting in favor, and State Senator Steve Glazer voting against.

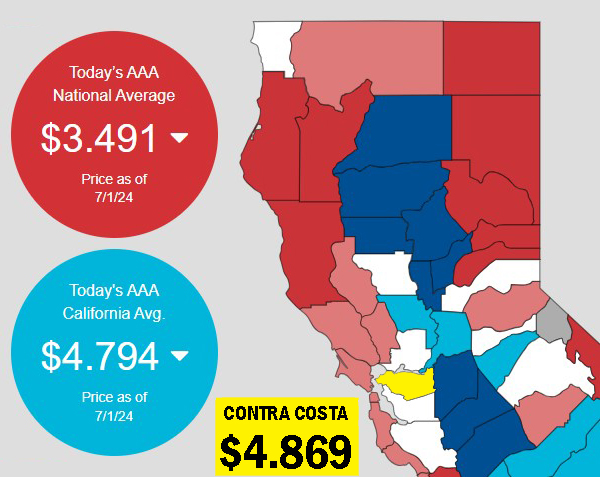

As of Monday, according to the American Automobile Association (AAA), which updates prices daily, drivers in Contra Costa County are paying an average of $4.869 per gallon of regular unleaded gas, while today’s Bay Area average is $4.943, California’s average is $4.794 and the national average is $3.491 per gallon.

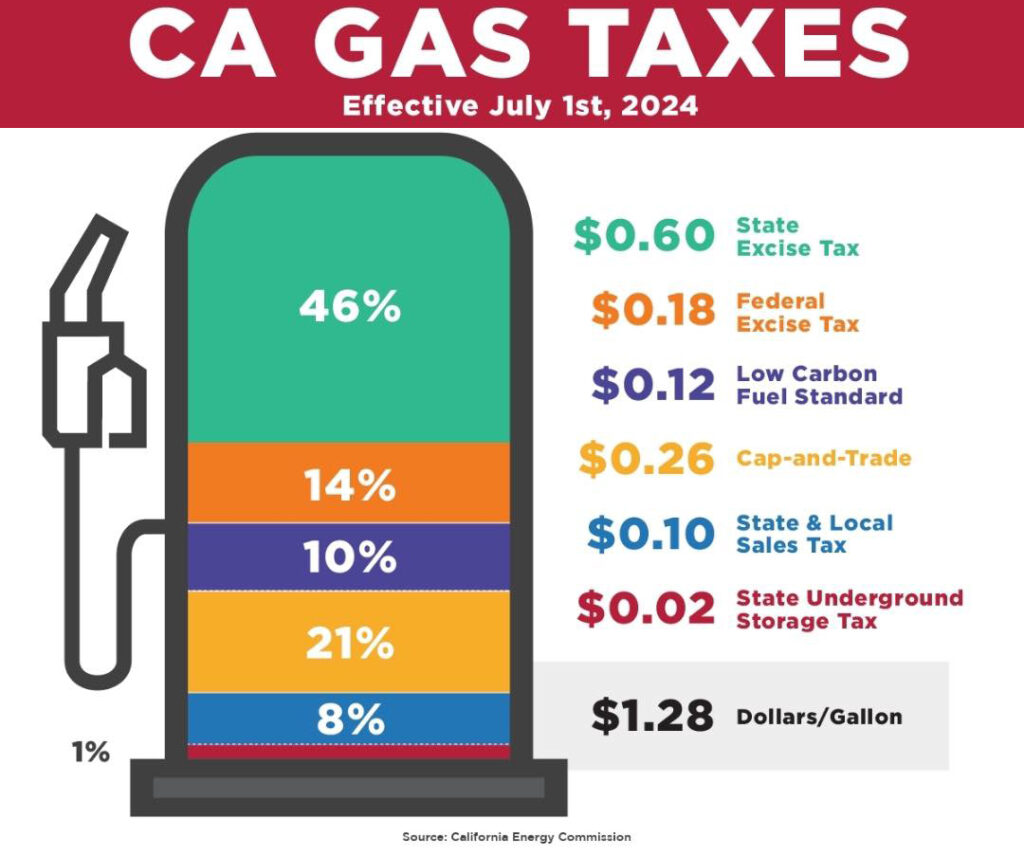

Taxes & Fees in the Price for a Gallon of Gas

According to data from the California Energy Commission, drivers are now paying 90 cents in taxes per gallon of gas:

- $0.596 on state excise tax

- $0.184 on the federal excise tax

- $0.10 cents on more state and local sales taxes

- $0.02 for a state underground storage tank fee

Plus, $0.51 for state environmental programs fee for a total of $1.41 in taxes and fees per gallon of gas.

But why does the state gas tax keep increasing each year? It’s due to the passage of a bill in 2017, not a vote of the people, as some folks misremember. According to the Metropolitan Transportation Commission (MTC), State Senate Bill 1 (SB1) entitled the Road Repair and Accountability Act of 2017, “was passed by a two-thirds majority in the California Legislature and signed into law by Governor Jerry Brown in 2017. As the largest transportation investment in California history, SB 1 is expected to raise $52.4 billion for transportation investments statewide over the next decade.” It marked “the first increase in the state excise tax on gasoline since 1994.”

It requires the CDTFA to annually adjust the rate by the increase in the California Consumer Price Index (CPI) which is as calculated by the Department of Finance (CDFI). According to the CADFI, the CPI “measures price changes in goods and services purchased by urban consumers. The all urban consumer (CPI-U) represents the spending patterns of the majority of the population which includes professionals, the self-employed, the poor, the unemployed, and retired people, as well as urban wage earners and clerical workers (CPI-W). The U.S. Bureau of Labor Statistics (BLS) compiles and publishes the CPI for the Los Angeles area monthly, the Riverside area bimonthly, San Diego County bimonthly, the San Francisco area bimonthly, and the nation each month. A California CPI is calculated…as a population-weighted average of the BLS-published local area CPIs. The California CPI formula was developed by the California Department of Industrial Relations (CADIR).”

According to the CDIR, the CPI “Is a measure of the average change over time in the prices paid by urban consumers for a fixed market basket of goods and services. The CPI provides a way to compare what this market basket of goods and services costs this month with what the same market basket cost, say, a month or year ago.” This year, the California CIP was determined to be 3.3% in February and 3.8% in April.

History of Recent CA Gas Tax Increases

In addition, according to details provided by the CDTFA, “*Effective July 1, 2010, under the Fuel Tax Swap Law, purchases and sales of gasoline are exempt from the state portion of the sales and use tax rate (then 6 percent), and a corresponding increase in the excise tax rate on that gasoline was imposed.” Then, “Effective November 1, 2017, Senate Bill 1 imposed an additional $0.12-per-gallon gasoline tax.” Finally, “Effective July 1, 2020, Senate Bill 1…requires CDTFA to annually adjust the rate by the increase in the California Consumer Price Index.”

Proposed Use of Funds

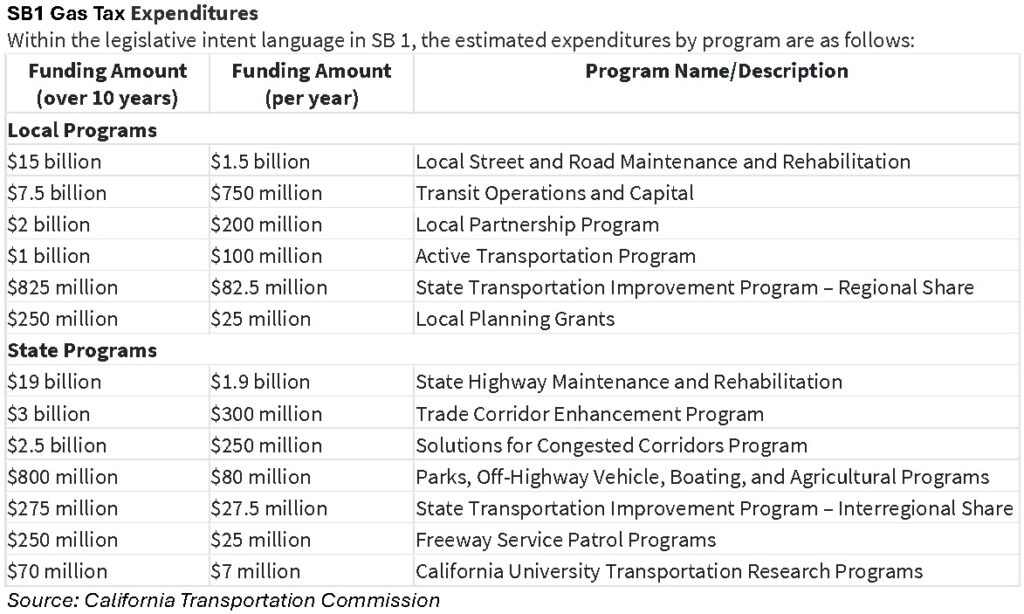

The majority of the revenue from the state gas tax is intended for “Local Street and Road Maintenance and Rehabilitation” at $1.5 billion per year over 10 years and $1.9 billion for “State Highway Maintenance and Rehabilitation.”

Also, according to the MTC, “In the Bay Area, most of this money will be directed to cities, counties and public transit agencies to tackle the enormous backlog of maintenance and repairs for local streets, roads and transit systems. SB 1 money also will be available for new projects, including bicycle and pedestrian improvements.”

Asked if the law sunsets and the annual increases end or if they continue indefinitely a staff member for CDTFA responded, “CDTFA is required by law to adjust the motor vehicle fuel and diesel fuel excise tax rates annually based on the California Consumer Price Index as calculated by the Department of Finance. SB1 did not include a sunset date.”

For additional information on SB1 see the answers by the California Department of Transportation (Caltrans) to the Frequently Asked Questions, here and by the California State Controller’s Office, here.

the attachments to this post:

SB1 Gas Tax Expenditures chart