Sales taxes – how much, what are they for and who raised them

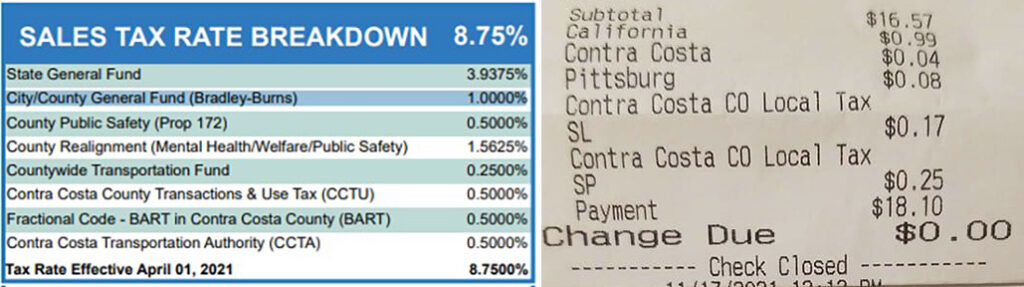

CCC Sales Tax Rate Breakdown chart and Chick-fil-A receipt.

I didn’t know that! Receipt from new Pittsburg Chick-fil-A raises questions – here are the answers

By Allen Payton

A post by someone, on Facebook, of their sales receipt from the new Chick-fil-A restaurant in Pittsburg, shows a breakdown of the sales tax they were charged. That started a discussion of what each of the line items is for.

I had never seen the sales tax broken down that way, previously, and I used to be a partner in a restaurant which collected sales tax and dealt some with it. I also served on the Contra Costa Transportation Authority for four years, but never knew the county received an additional .25% and the cities 1% in sales tax for transportation above the .5% for which we oversaw the expenditures. Nor have I seen the breakdown of the 6%, until now.

So, I set out on a quest to learn the details of the sales taxes we pay for many if not most of the purchases we make in Contra Costa County.

Once you read this, you too may say as I did, “I didn’t know that!”

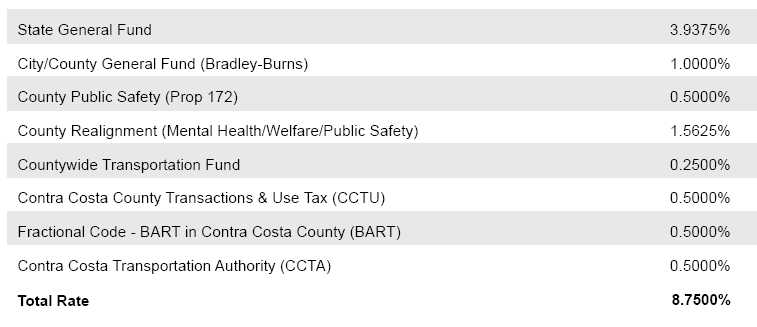

County Finance Director Lisa Driscoll pointed out that on the Sales Tax page of the County’s website, each Quarterly Tax Report includes a breakdown of the sales tax, which answered most of my questions. She also mentioned the 1% “Bradley‑Burns” tax which is received by the cities for transportation.

On the State Auditor’s website, about The Bradley‑Burns Tax and Local Transportation Funds, it reads, “The tax charges 1.25 percent on the retail sale or use of tangible personal property in the State, of which 1 percent is allocated to counties or incorporated cities to use at their discretion and the other 0.25 percent is allocated to county LTFs.”

In Contra Costa County we also pay the voter-approved half-cent sales tax for BART operations, another half-cent sales tax from Measure J, passed in 2004, for transportation projects which is overseen by the Contra Costa Transportation Authority, a half-cent approved by the voters with the passage of Prop. 147 in 2019 for public safety, and another half-cent from Measure X, passed last year, which is allocated by the Board of Supervisors. (See related article)

Source: Contra Costa County

Driscoll also shared, “The County does not actually collect any sales tax and the rate varies by location. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state’s sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. The unincorporated rate is listed below.”

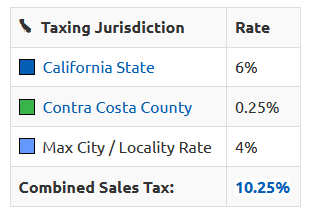

Each city’s sales tax rate can be different because they might also have a local sales tax the voters passed, such as in Antioch where they passed two half-cent sales tax increases, mainly to pay for more police, and has a rate of 9.75%. The highest sales tax rate can be a whopping 10.25% and the only city in Contra Costa County to have the maximum is El Cerrito! To see the sales tax rate in your city or community, click here.

As someone who advocates shopping local instead of online, to help support our local retailers and keep our sales tax revenue, you’d think I would know this stuff. But alas, no. So, this has been enlightening for me.

Plus, people, including me, tend to forget about the voter-approved taxes, including 2% of the sales tax in our county, and it’s good for us to be informed or reminded of why we’re paying them and who imposed the various taxes on “we the people”. Just like with the $9.5 billion for the California high-speed rail, about which I’m constantly having to remind people who complain about the state spending their tax dollars on it, that the voters approved that amount in bonds for the project. The same with the law making it only a misdemeanor for shoplifting less than $950 in goods due to Prop. 47. People, we did it to ourselves! LOL

As for the breakdown in the state sales tax and the 1% Bradley-Burns sales tax, say it with me, “I didn’t know that!” Well, now we do.

the attachments to this post:

CCC Sales Tax Rate Breakdown chart & Chick-fil-A rcpt