BART Board votes 8-1 to close up to 15 stations if proposed Nov. tax measure fails

Friday, February 27th, 2026

Contra Costa’s 4 representatives vote to adopt Alternative Service Plan to balance budget including 1,170 employee layoffs

Ridership still down 50% post-COVID

By Allen D. Payton

On Thursday, Feb. 26, 2026, the BART Board of Directors, on vote of 8-1, adopted an Alternative Service Plan outlining specific budget balancing details to solve a $376M deficit for the next fiscal year if no new funds become available to BART. According to a District press release, BART is facing a structural deficit of $350M to $400M because ridership is still down 50% compared to pre-pandemic levels and BART’s current funding model relies heavily on passenger fares.

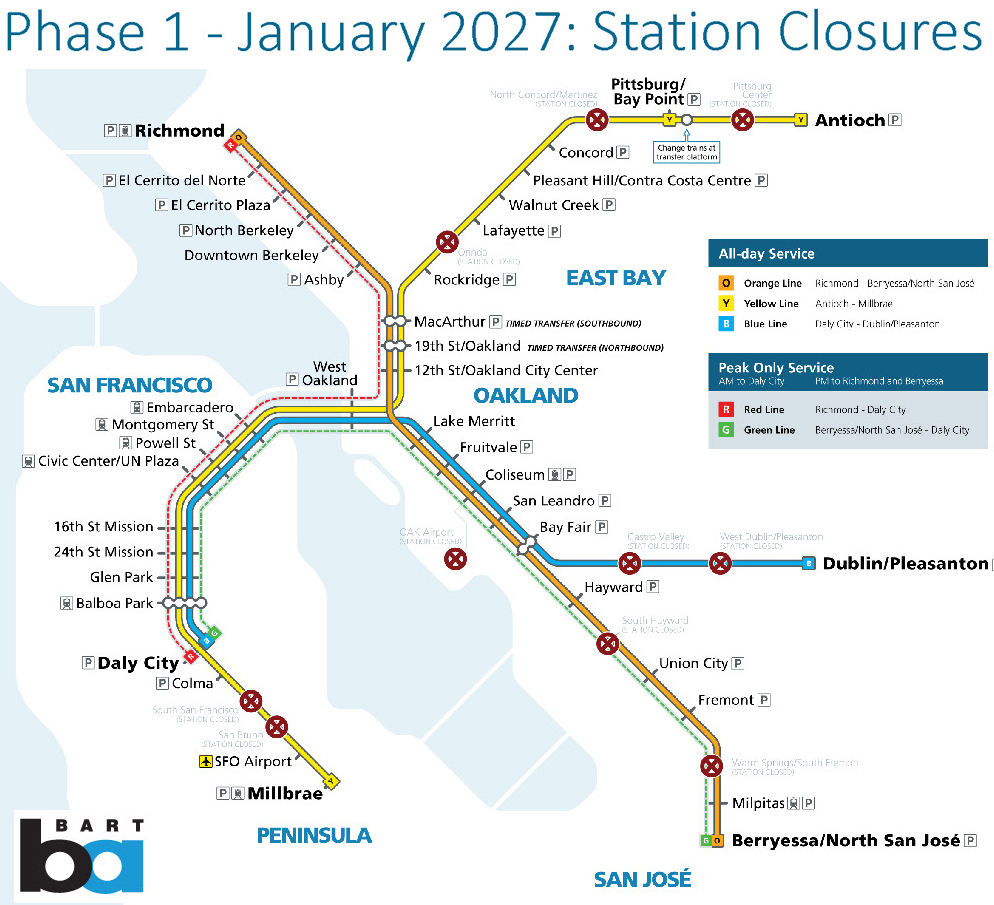

As previously reported by the Herald, the stations on the list for potential Phase 1 closure in January 2027 include the 10 lowest ridership stations: North Concord, Orinda, Pittsburg Center, Oakland International Airport, West Dublin/Pleasanton, Castro Valley, San Bruno, South Hayward, South San Francisco and Warm Springs/South Fremont.

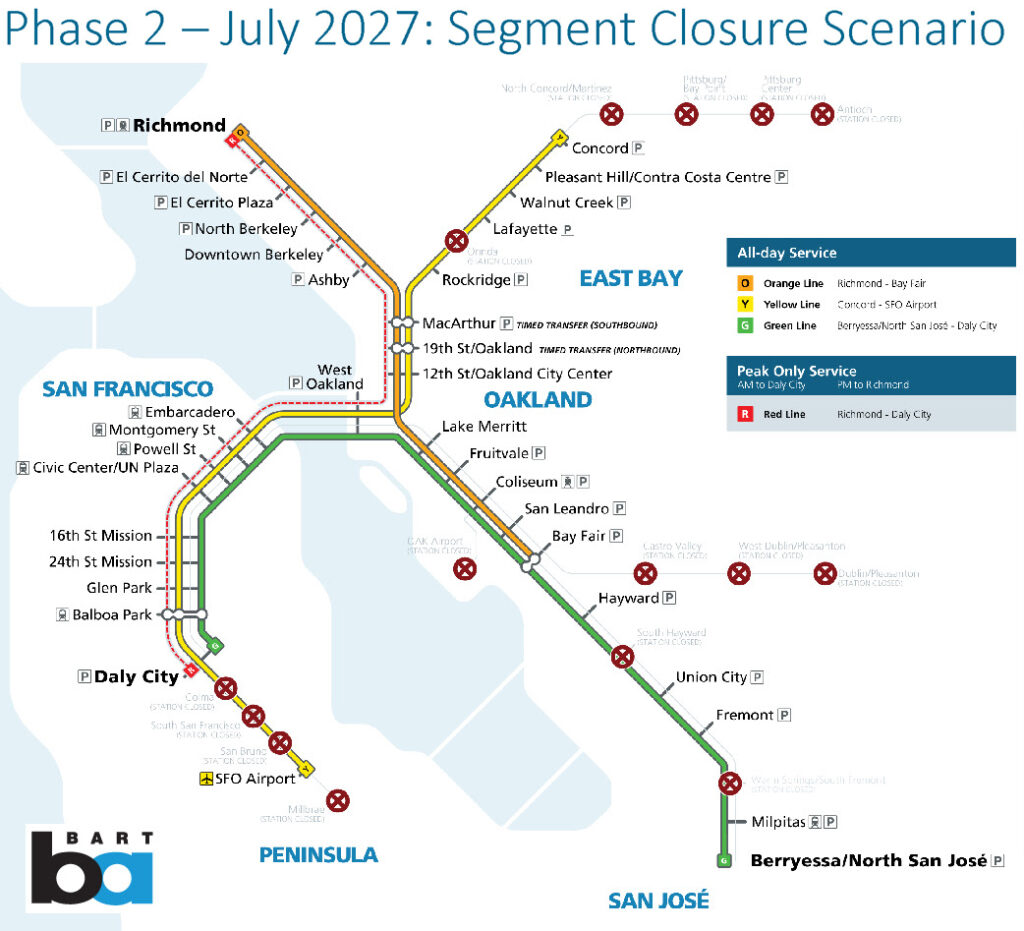

Phase 2 Closures Include Antioch and Pittsburg/Bay Point Stations

The Phase 2 – July 2027 Segment Closure Scenario, Contingent on Phase 1 implementation, would result in a 70% reduction in train hours and 25% reduction in system miles; Segment closures would stop service on most system segments opened after 1976: Yellow line service would end at Concord, shuttering the Pittsburg/Bay Point and Antioch Stations; Orange line service would end at Bay Fair,; Blue line service would be discontinued shuttering the West Dublin/Pleasanton Station; Most stations south of Daly City would be closed except for direct service to SFO would continue for revenue retention; Service continues to Milpitas and Berryessa due to terms of BART/VTA agreements.

Based on Proposed Transit Tax Measure Failing

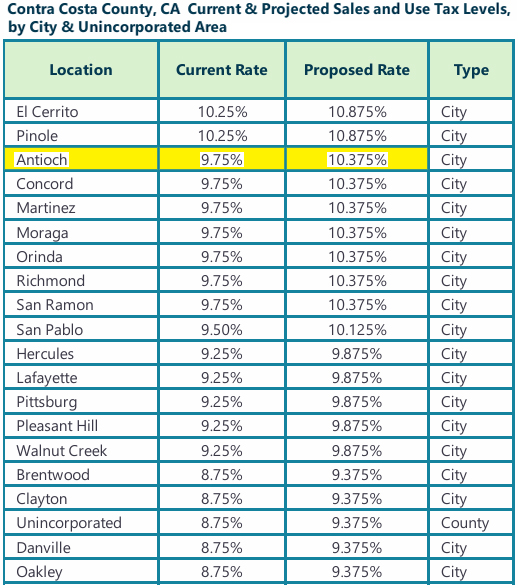

The plan is based on the assumption a sales tax increase measure proposed for the November ballot in five Bay Area counties fails. As previously reported, voters would be asked to consider a one-half sales tax increase in Contra Costa, Alameda, San Mateo and Santa Clara counties and a one-cent sales tax increase in San Francisco County. The 14-year regional transportation sales tax would generate approximately $980 million annually with 60 percent dedicated to preserving service on BART, Muni, Caltrain and AC Transit, as well as San Francisco Bay Ferry and smaller transit agencies providing service in the five counties to keep buses, trains and ferries moving, including WestCat, County Connection and Tri Delta Transit. About one-third of the revenue would go to Contra Costa Transportation Authority, Santa Clara VTA, SamTrans and the Alameda County Transportation Commission, with flexibility to use funds for transit capital, operations, or road paving projects on roads with regular bus service.

Also, as previously reported, an effort is underway to gather signatures to place the measure on the ballot. The sales tax increase would be in addition to the half-cent sales tax for BART operations in Contra Costa, Alameda and San Francisco counties in place since the 1960’s.

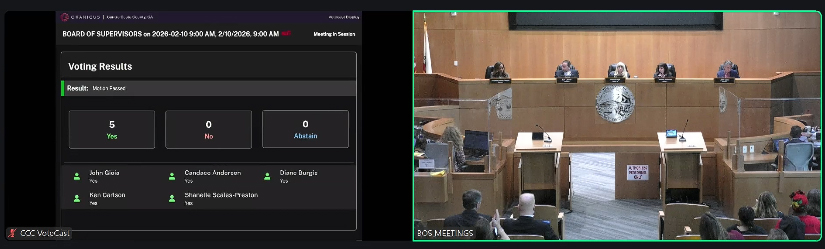

Motion and Vote Details

Following public comments and discussion among the Board members a vote was taken on the following motion: The Board adopts the attached Resolution “In the Matter of Initially Approving an Alternative Service Plan to Take Effect January 2027 in the Event the Connect Bay Area Measure Fails to Receive Voter Approval at the Statewide General Election on November 3, 2026 and BART is Unable to Secure Other Revenue Sources.”

The motion was made by District 4 Director Robert Raburn, seconded by District 1 Director Matt Rinn, and passed on a vote of 8-1 with the additional support of District 7 Director Victor Flores, District 2 Director Mark Foley, District 3 Director Barnali Gosh, District 8 Director Janice Li, Board Vice President and District 9 Director Edward Wright and Board President and District 5 Director Melissa Hernandez.

District 6 Director Liz Ames was the only member of the Board of Directors to vote “No”.

Foley represents portions of Central County and all of East County, Rinn represents portions of Central Contra Costa County, all of Lamorinda and most of the San Ramon Valley, Gosh represents all of West County and Hernandez represents portions of San Ramon.

Approved Plan Details

The plan includes specific cuts and financial strategies needed to balance both the FY27 (July 1, 2026-June 30, 2027) and FY28 (July 1, 2027-June 30, 2028) budgets. The plan includes service cuts, station closures, fare increases, a 40% reduction in system support services, laying off 1,170 employees and a series of deferrals and one-time resources. The plan does not name specific stations to be closed and makes clear the BART Board will be responsible for all decisions on station closures. You can read the Alternative Service Plan resolution, resolution attachment and presentation to the BART Board.

BART has already made budget cuts across all departments and instituted a series of cost controls, including rightsizing service, labor savings, operational efficiencies, and reducing BART’s office space footprint. At the same time, BART has also worked to increase revenue by installing new fare gates, leasing out BART parking lots, and offering new fare products such as Clipper BayPass. View a detailed list of cost savings implement by BART at bart.gov/fiscalcliff.

Alternative Service Plan Details

To take place in January 2027:

- 3-line service (Yellow, Blue, and Orange line service only, with limited peak service in only the peak commute direction on the Red and Green lines).

- 30-minute frequencies on every line.

- Closing at 9 pm seven days a week.

- This service plan represents a 63% reduction in train hours.

- 30% fare and parking fee increases (the estimated average fare would increase from $4.98 to $6.38).

- Target approximately $30M in savings over 6 months from non-service budget reductions to fleet and non-fleet maintenance, police, cleaning, and administrative support functions.

- Continue deferrals of priority capital allocations and retiree medical contributions.

- Balance remainder of FY27 with one-time resources and financial deferrals.

Following the January 2027 cuts, staff will continuously assess ridership and revenue impacts and the performance of all District functions to determine if further reductions can be safely and legally implemented.

To take place in July 2027 if feasibly safe:

- Target over $175M in annual cost reductions through a cumulative 70% reduction in service hours:

- Maintain 3-line service, 30-minute frequencies on each line, closing at 9pm.

- Close up to 15 stations and/or up to 25% of system track miles.

- The BART Board will be responsible for all decisions on station or line segment closures.

- Increase fares and parking fees up to a cumulative 50%. The estimated average fare would increase to $7.26.

- Target annual operating expense savings of more than a cumulative $130M from non-service budget reductions to fleet and non-fleet maintenance, police, cleaning, and administrative support functions.

- Continue to defer retiree health contributions; defer most remaining capital allocations.

Contingency:

- If at any point it is determined BART can’t safely or legally operate with available resources, stop passenger service.

- Use existing District tax revenues to secure system assets.

- Work to determine system’s future.

Use of the State Loan

BART can’t use state loan money to avoid station closures and service cuts if no new revenue becomes available because without new revenue, there is no way to pay the loan back. The state loan primarily helps with cash flow if a November 2026 transit funding measure is successful. It is a bridge loan that gives BART reassurances money will be available to continue to deliver the best service possible until the sales tax dollars from the successful ballot measure become available for BART’s use. This is projected to happen in July 2027 but could take longer. If a funding measure succeeds, BART will use $97M in loan funds to help balance the FY27 budget.