Unions backing Wilson in Assembly race spend $253K attacking opponent Mitchoff

Thursday, February 29th, 2024

By Allen D. Payton

Some of the same unions backing Antioch Mayor Pro Tem Monica Wilson in the Assembly District 15 race on the March primary ballot have spent almost $253,000 attacking one of her three opponents, former Contra Costa County Supervisor Karen Mitchoff.

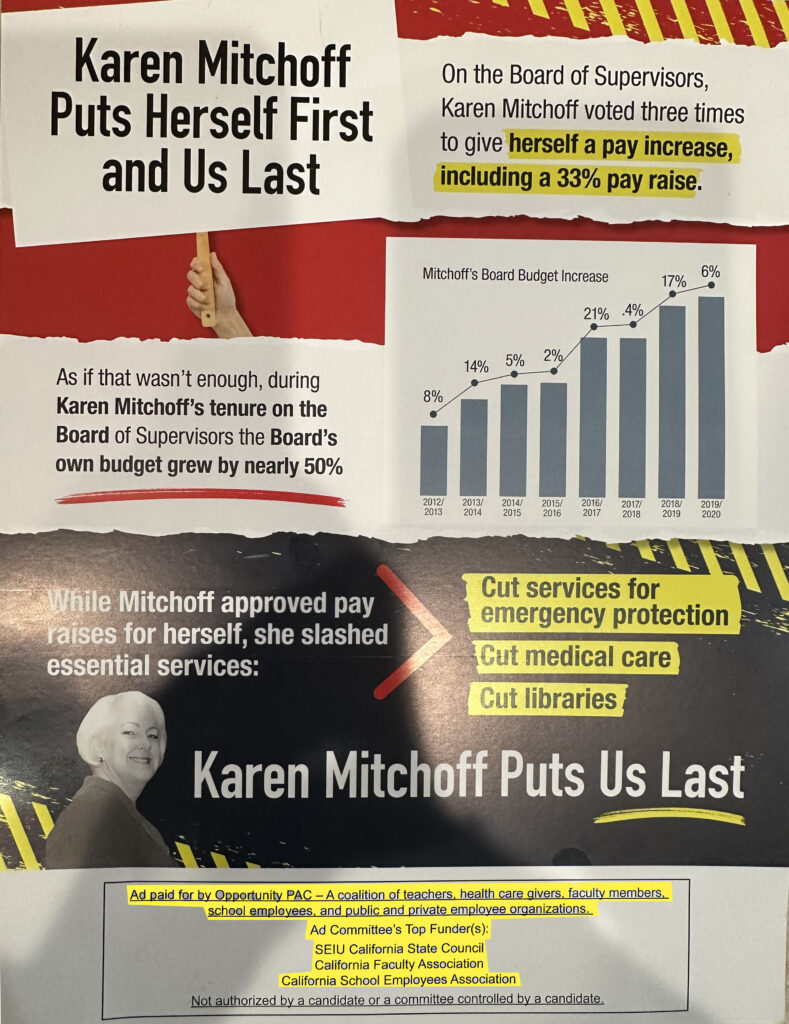

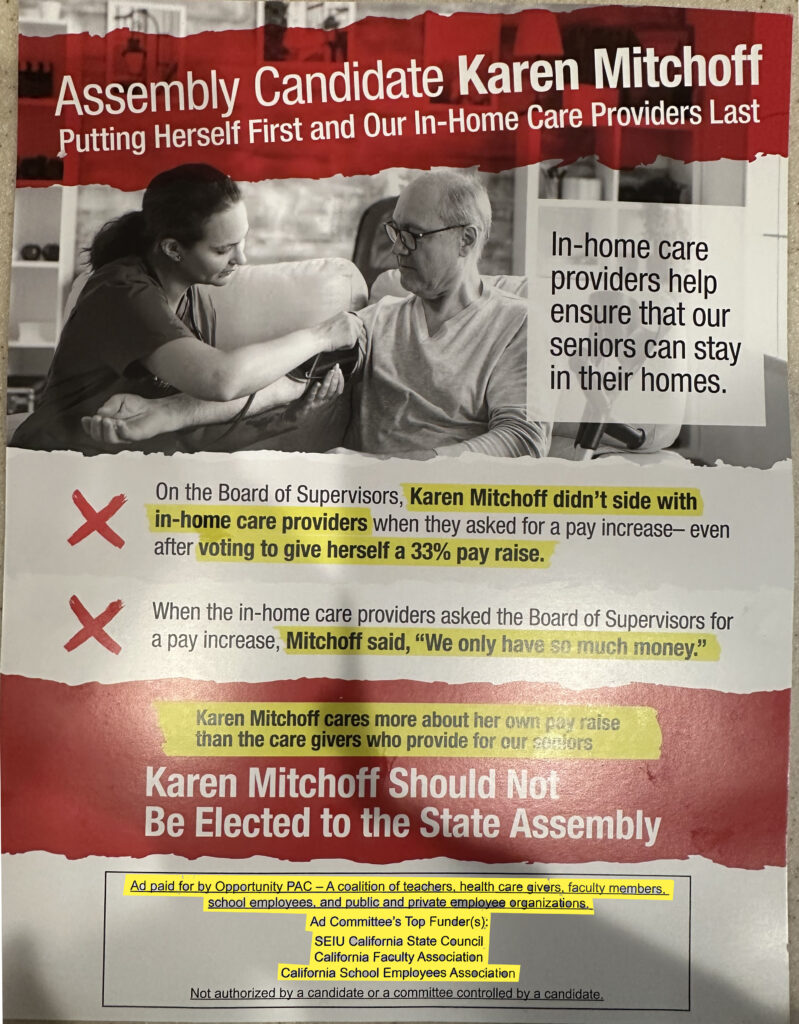

At least four mailers have been sent to Democrat voters in the district criticizing Mitchoff’s pay raise she voted for while on the board, and her votes against pay raises for county employees.

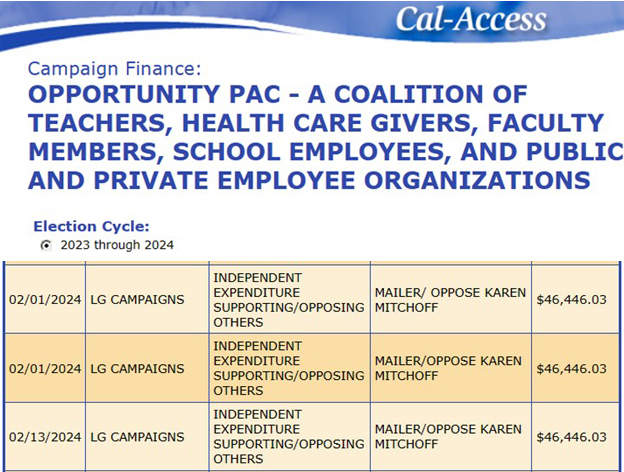

Two of the mailers obtained by the Herald show they were paid for by “Opportunity PAC – A coalition of teachers, health care givers, faculty members, school employees, and public and private employee organizations.” The political action committee’s Top Funders for the mailers are listed as SEIU (Service Employees International Union) California State Council, California Faculty Association (of the UC and CSU systems) and California School Employee Association.

When asked about the mailers Mitchoff said they’re all pretty much about the same issue. “The same group with the same message. My decision on the pay raise was made over 10 years ago because I wanted to make sure the county supervisors were paid enough to make it a full-time position.” She also pointed out that she did vote for pay raises for county employees, “in 2022, giving them 5% a year for four years, for a total increase of 20%.”

The interesting part is that some of the state teachers’ unions including college and university faculty and staff are helping pay for the mailers, even though as a member of the Board of Supervisors, Mitchoff had no say about education funding.

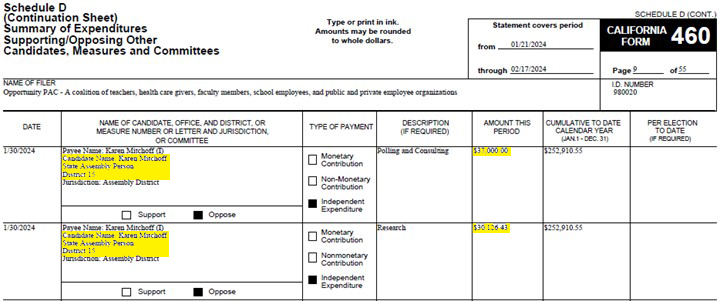

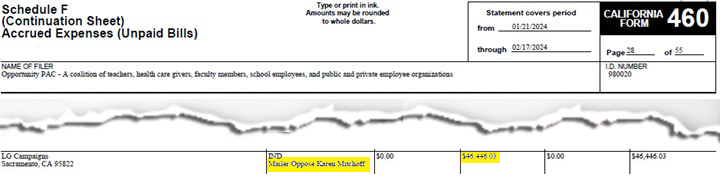

According to Cal-Access, the California Secretary of State’s campaign finance reporting website, so far, the PAC has made three expenditures of $46,446.03 each for three mailers opposing Mitchoff, two on Feb. 1 and one on Feb. 13, 2024. The cost for a fourth mailer that appear under the PAC’s Accrued Expenses show an additional $46,446.03. That totals $185,784.12. In addition, the PAC spent $37,000.00 on polling and consulting and $30,126.43 on research in their effort against Mitchoff.

Contributions to PAC Total Over $2.5 Million

The PAC is supporting and opposing a variety of candidates throughout the state. Their most recent Form 460 financial disclosure report dated Feb. 17, 2024, shows they have raised $1.715 million this year and their report ending Dec. 31, 2023, shows $803,500 was raised last year for a total of $2,518,500. They had cash on hand of over $1.1 million as of Feb. 17th.

Contributions include the following amounts and sources:

$750,000 from the California Teachers Association Independent Expenditure Committee;

$534,500 from SEIU California State Council for Working People;

$225,000 from PACE (Political Action for Classified Employees) of California School Employees Association;

$190,000 from Smart Justice California Action Fund;

$150,000 from United Food and Commercial Workers Western States Council Independent Expenditure PAC;

$150,000 from California Federation of Teachers COPE (Committee on Political Education);

$150,000 from Service Employees International Union Local 1000, Keeping California Healthy, Safe and Strong;

$100,000 from Service Employees International Union Local 721 CTW, CLC Workers’ Strength Committee;

$75,000 from SEIU United Healthcare Workers West PAC;

$59,500 from Faculty for Our University’s Future, a committee sponsored by California Faculty Association;

$59,500 from Standing Committee on Political Education of the California Labor Federation AFL-CIO;

$50,000 from the LGBT (Lesbian, Gay Bisexual & Transgender) Caucus Leadership Fund; and

$25,000 from SEIU California State Council (nonprofit 501 (c)(5))

Wilson’s Backers Funding Mitchoff Opposition Effort

Wilson’s campaign has been the beneficiary of support from many of those same unions. On her campaign website, Wilson shows endorsements by the California Faculty Association, SEIU California, National Union of Healthcare Workers (NUHW) and United Food & Commercial Workers Local 5, as well as unions that are members of the AFL-CIO.

Wilson and Mitchoff also face two others in the race, including County School Board Trustee Anamarie Avila Farias and Realtor Sonia Ledo in the March 5th primary election next Tuesday. The top two will face off in the November election.