The following Open Letter was sent to the AUSD Board on Saturday, July 18 regarding the AUSD webinars of July 16, 2020 and Governor Newsom’s press conference of July 17, 2020

The following Open Letter was sent to the AUSD Board on Saturday, July 18 regarding the AUSD webinars of July 16, 2020 and Governor Newsom’s press conference of July 17, 2020

Dear Board Members and Others,

My name is Mark Hadox and I am concerned about the AUSD plans for using the hybrid model for the upcoming 2021 school year.

There are many ideas and various models of school re-opening and learning methods for 2021.

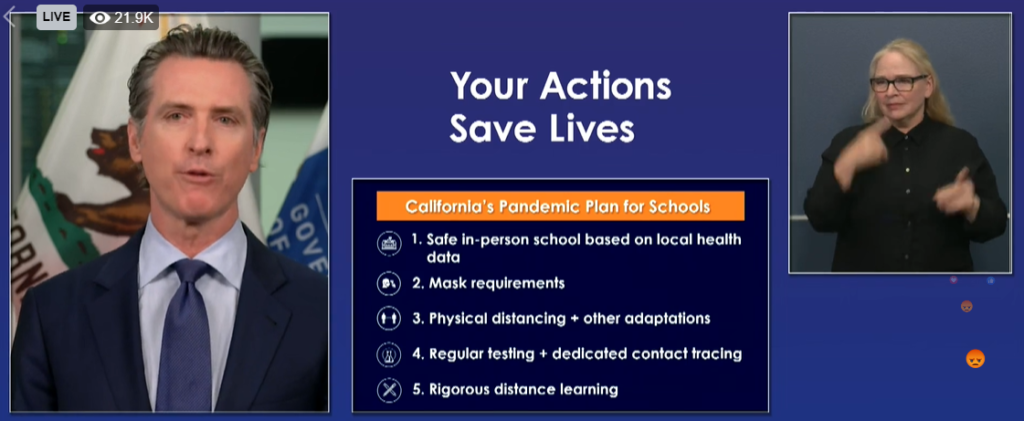

On Friday, Governor Newsom laid out mandatory guidelines for opening schools and closing schools. School openings will only happen upon general county-wide health criteria being met as well as specific school and district criteria. Now AUSD must form a plan which works within the governor’s criteria and has the best chance of success.

After schools are permitted to open the governor’s plan calls for closing schools and returning to distance learning when any of the following conditions are met:

a) One person in a class with confirmed positive would cause the 14-day quarantine of those exposed to that person.

b) school reverts to distance learning when multiple cohorts have positive cases

c) or school reverts to distance leaning when 5% of students and staff test positive

d) district reverts to distance learning when 25% of schools have been closed

After 14 days under each condition the school may return to in-person instruction with the approval of the local public health officer.

How do those state mandated criteria apply to AUSD in real numbers?

From Wikipedia, there are about 17,000 AUSD students so with a student to teacher ratio of, say 27, the result is approximately 630 classrooms and 630 teachers and hundreds more specialty teachers, substitutes, and staffing.

When each of those 630 classes are split into two cohorts for in-class teaching that will be 1,260 cohorts, spread among 25 schools in the district, including two of our six high schools having about 2,000 students each.

Note, per Contra Costa Health on 7/17, the current positive countywide test rate is 8%.

Applying an 8% positive rate to cohorts of 13 students the result would be 1.04 positives, so it seems pretty clear that right off the bat many cohorts will meet the criteria for the immediate 14-day quarantine of that cohort. Many more than one of the 1,260 cohorts in the district are certainly going to be affected early on in the school year.

Remember, even just two positive cohorts requires a school to revert to distance learning.

Also, an entire district closure happens when 25% of schools close, which would be 6 of AUSD’s 25 schools, it is readily apparent that a few positives will result in the district meeting the 6 school threshold to close the district quite quickly.

Even if the infection rate is cut in half to 4%, that is still about 700 positive throughout the AUSD population of students and staff. It only takes as few as 2 positives to close a school and so as few as 12 positives can close six schools and thus the whole district.

The missing key to the governor’s positive test criteria is how will any school find out about any person’s positive test results?

Unless schools themselves test every person entering campus and maintain the results thereof, then the heath of everyone on site will be left up to parents reporting to the school the medical condition of their children. Certainly, the first thought of a parent with a sick child will be childcare and not to call the school to report it. And what about asymptomatic positives? Without testing they will never be found.

While we all want to return to the days prior to corona virus, we must keep in mind that our hope does not out weigh the fact that the corona virus is out there, people transmit it easily, unknowingly, and it will not stop simply because we wish it to.

It is also clear that even if a vaccine is produced, it will likely not be 100% effective and on top of that there may well be a large percentage of parents who will refuse it even if it were 100% effective. That said, the new normal may be permanent distance learning for a large portion of our student population if, hopefully, being vaccinated becomes a requirement for in-class learning. Developing a strong distance learning model is imperative.

AUSD needs to get real and go all in on distance learning now. It is prudent to consider that the new normal for all of 2021 will likely be solely distance learning and to put all effort into making that model work.

Superintendent Anello said that many parents want in class teaching and that the social and emotional needs of the students are a major concern. But in-class teaching may actually cause emotional harm, really. Has it been explained to parents how in-class teaching will be done? The students will be practically seat-belted into their chairs, they will not be able to touch anyone, share anything, or play in any groups, they even need to each their lunches alone at their desks. They won’t be able to mix with their friends, before, during, or after school. They will constantly be admonished to keep their masks on, don’t do that, stay over there, etc.

The governor requires that every school day, that anyone entering the campus must receive and pass a health screen, what emotional toll will that take? Will a student’s cohort’s parents be told that a classmate of their child didn’t pass the health screen, does AUSD plan to inform parents when that happens? Since cohorts can’t be mixed, what is the protocol for when a teacher is absent? Oh, and while the governor says that K-2 students are only encouraged to wear masks rather than being required to, mask wearing in public is required for everyone over the age of two, will AUSD require all K-12 students to wear masks? The governor’s Pandemic Plan states that, “Over the course of the pandemic, most schools will likely face physical closure at some point…”, have the parents been informed that in-class learning will be variable and unpredictable at all levels from classroom, to school, to district?

I would really appreciate a reply to my questions, they are not rhetorical.

I believe that if all parents were provided with a clear picture of their child’s likely in-class learning experience and emotional challenges, that many of those parents who may have wanted in-class learning back in May would not feel that way now.

Sincerely,

Mark Hadox

Antioch Resident and Parent of AUSD graduates

The following Open Letter was sent to the AUSD Board on Saturday, July 18 regarding the AUSD webinars of July 16, 2020 and Governor Newsom’s press conference of July 17, 2020

The following Open Letter was sent to the AUSD Board on Saturday, July 18 regarding the AUSD webinars of July 16, 2020 and Governor Newsom’s press conference of July 17, 2020

By Allen Payton

By Allen Payton San Juan Capistrano, CA – California Connections Academy, a tuition-free network of

San Juan Capistrano, CA – California Connections Academy, a tuition-free network of