Contra Costa Supervisors vote 5-0 to place 5-year 5/8-cent sales tax increase on June ballot

To pay for healthcare costs, offsetting cuts in federal budget

If passed, Antioch’s sales tax rate would increase 0.625% to over 10%

By Allen D. Payton

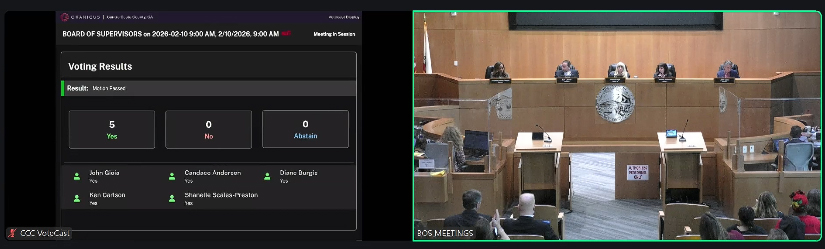

During their regular, weekly meeting on Tuesday, Feb. 10, 2026, the Contra Costa County Board of Supervisors decided to tell the taxpayers that they love our money by giving an early Valentine’s Day gift of a 5/8-cent sales tax increase measure on the June ballot. As a general tax, a simple majority of voters will have to give it their support in order to pass. If they do, it will generate an estimated $150 million per year for five years for a total of $750 million, intended to pay for healthcare for county residents impacted by federal budget cuts.

To adopt the sales tax ordinance a 4/5 vote of the Board was required but it passed unanimously. According to the proposed “2026 Retail Transactions (Sales) and Use Tax Ordinance”, all of the proceeds from the tax will be placed in the County’s general fund and used for purposes consistent with general fund expenditures of the County.

Timeline to the Supes Vote

In the staff presentation for the proposed ordinance, the supervisors were provided with the timeline of events that led up to their vote: On November 18, 2025, the County Administrator’s Office offered a presentation on the State Budget and impacts of H.R.1, known as the One Big Beautiful Bill, passed by Congress and signed into law by President Trump which cuts healthcare expenditures. Then, on December 16th, the Health, Employment and Human Services departments provided an in-depth presentation on federal and state financial impacts. That was followed on January 20th by Board direction for seeking legislation allowing for an additional 0.625% general sales tax and development of a related taxing ordinance for a period of five years. Finally, during last Tuesday, February 3rd’s Board Retreat, presentations from Beacon Economics, the County Finance Director, California Welfare Director’s Association (CWDA) and the California Association of Public Hospitals & Health Systems (CAPH) were made to the Board.

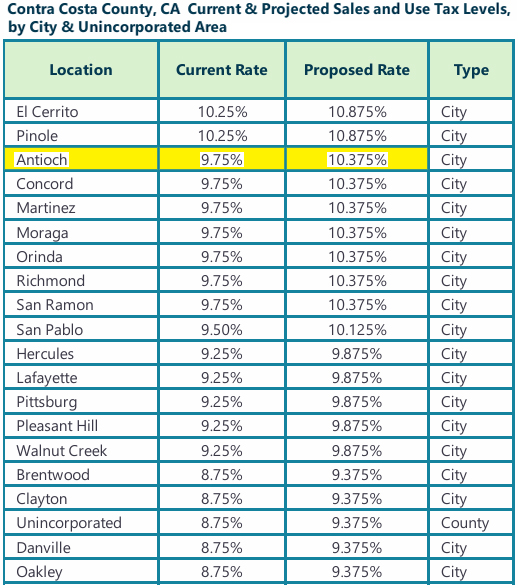

Projected Sales Tax Levels by City

If the measure passes, the amount of sales tax collected in each city in the county will increase by 0.625% or 62.5 cents for each $100 spent on taxable items. The presentation shows the sales tax increase would cause 15 of the 19 cities in the county to be above the local sales tax cap, including the tax cap changes from SB1349. That law, passed in 2020, allowed Contra Costa County to impose a sales tax of up to 0.5% for transportation projects, which is exempt from the state’s 2% cap. According to an April 2025 Issue Brief on Sales and Use Tax by the California State Association of Counties, “Today, the statewide sales tax rate on eligible taxable goods is 7.25%.”

According to the CA Department of Tax and Fee Administration, “The…7.25%…is made up of three parts:

- 6.00% State

- 1.00% Local Jurisdiction

- 0.25% Local Transportation Fund

Some components of the state rate go to various local revenue funds.”

In addition, “Cities may impose a rate of up to one percent (1%).”

In California, the local sales tax cap is generally set at 3.5% above the 6% state sales tax rate for a total of 9.5%.

Following is the list of the new sales tax amounts by city if the county measure passes:

The cities with the highest current sales tax rates in the state are Alameda and Albany at 10.75%. With the proposed Contra Costa sales tax increase, El Cerrito and Pinole would have the highest sales tax rate in both the county and state at 10.875%. Antioch would have the second highest in the county at 10.375%. That does not include other sales taxes that may be passed in 2026 including the regional transit tax slated for the November 2026 ballot, which would be an additional 0.5% Countywide. (See related article)

Gioia Offers Comments on Facebook, in TV Interview

In a post by John Gioia on his Facebook page, today, Feb. 11th, he shared a video of his comments during a KTVU FOX2 interview “about why a unanimous bi-partisan Board of Supervisors is placing a 5/8 cent temporary 5-year sales tax on this June’s ballot to protect our county’s hard working families from Trump’s devastating health, human services and food assistance cuts.”

“The average Contra Costan would pay about $10 per month to prevent over 50,000 people from losing healthcare and crowding emergency rooms that we all use and protecting emergency response times,” he added.

Resolution Details

The Resolution adopted by the Board includes the following clauses, “On July 4, 2025, the President signed H.R. 1, which enacted the deepest cuts in our country’s history to Medicaid and the federal food assistance programs;

“Medicaid and Medicare are the largest sources of revenue for the County’s public health and hospital/clinic system, which provide lifesaving and essential care to county residents, including Medi-Cal beneficiaries, Medicare recipients, and uninsured residents.

“H.R. 1 immediately freezes supplemental Medicaid funding and blocks the County from drawing down expected supplemental payments, producing escalating negative impacts on the County’s budget, while simultaneously making significant eligibility changes which will cause thousands of county residents to lose health coverage;

“Lack of health coverage often causes people to delay medical care resulting in sicker residents and will increase demand for emergency care sought by residents no longer able to access preventative healthcare after losing insurance coverage;

“More than 335,000 County residents rely on Medi-Cal for their health care, and the County is the primary health-care provider for this population;

“H.R. 1 also makes substantial reductions to Supplemental Nutrition Assistance Program (SNAP), limiting food assistance relied upon by approximately 110,000 county residents;

“As a result of the federal funding cuts and rising costs, the County projects annual revenue losses exceeding $300 million by 2029;

“The combination of decreased federal funding with the increased demands on the County’s healthcare and social services threatens ALL County services, from public safety to homeless services;

“An additional five-eighths of one cent countywide general transaction and use tax (sales tax) would generate an estimated $150 million annually for five years…”

Adopted Proposed Ballot Measure Language

The resolution also includes the proposed ballot measure language pending approval by the County Clerk’s Office:

“To help Contra Costa County address deep cuts in federal funding; support critical local services such as health care, supplemental food assistance, and other general county services; and reduce the risk of closures at Contra Costa’s regional hospital and health clinics, shall Contra Costa County adopt a five-eighths of one cent general sales tax for 5 years, providing an estimated $150,000,000 annually, not available to the federal government and subject to annual audits and independent citizens oversight?”

The primary election will be held Tuesday, June 2, 2026.

For more details see Discussion Item D.2. on the Board Agenda for their meeting on Feb. 10, 2026, and watch the meeting video beginning at the 2:20:18-minute mark.

the attachments to this post:

Sales & Use Tax Levels by City – Antioch highlighted

CCC Board of Supes Sales Tax Ballot Measure vote 02-10-26