Gov Newsom speaks at Motel 6 in Pittsburg to announce the state’s new Homekey program on Tuesday, June 30, 2020. Screenshot from press conference video.

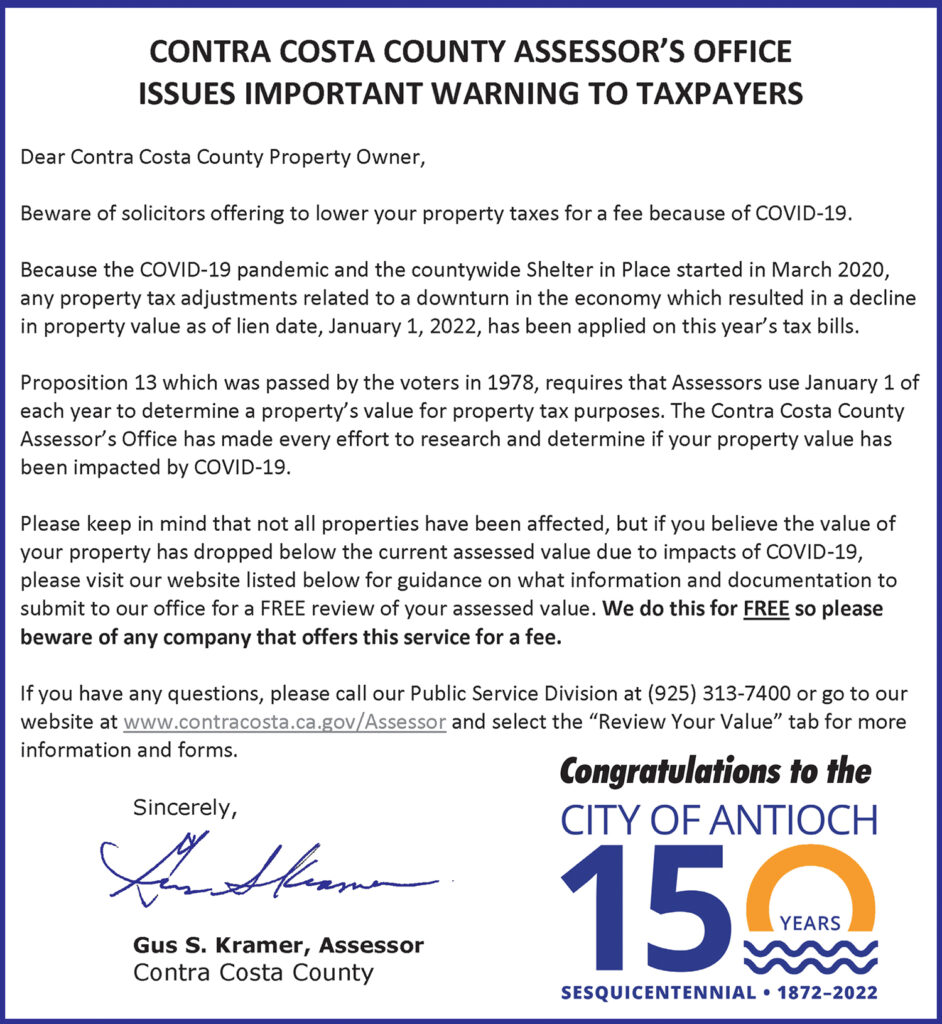

$21.6 million total for program; approved as a consent calendar item and the last item on the agenda without discussion; no appraisals included; Glover, Kramer split on issue; appraises at $16.7 million

Motel 6 Pittsburg. Photo by Motel 6.

By Daniel Borsuk

The light will be left on for homeless, now at the Motel 6 in Pittsburg. Contra Costa County Board of Supervisors may have quietly went about unanimously approving $21.6 million for the purchase of the motel and almost two years of operations, as part of the state’s Homekey program to help the homeless find shelter, food, jobs and get social services, but the Board’s consent action on Tuesday also demonstrates how far apart two political candidates – longtime District 5 Supervisor Federal Glover and challenger Contra Costa County Assessor Gus Kramer – are on the issue of homelessness.

The agenda item was quietly acted on as a consent item, and the last on the agenda. There was no discussion on the item, nor were copies of the two appraisals by the county’s Public Works Real Estate Division included with the agenda. Attempts to obtain the appraised value for the property from members of the Board, County Administrator David Twa, and the Public Works Real Estate Division were unsuccessful prior to publication time. However, Supervisors Federal Glover, in whose district the motel is located, as well as Candace Andersen and Diane Burgis said they would work to provide the information. The only documents included with the agenda item were the purchase and sale agreement and deed of sale. Motel 6 Pittsburg – Purchase & Sale Agrmt final 10.12.20

Located at 2101 Loveridge Road in Pittsburg, the County, with the state’s financial assistance decided that acquisition of the Motel 6 will increase the number of shelter beds permanently available in East County from 20 beds to 174 beds, a 770 percent increase. In addition to providing shelter, the program, funded under the state’s Home Key Program, would provide health care, behavioral health and other services to residents.

Contra Costa, along with the counties of San Francisco, Alameda and Santa Clara have now drawn state Homekey funds in the fight to solve homeless issues.

“This will be a great opportunity to get people off the street,” said Supervisor Glover who faces Kramer in a November 3rd face-off election because neither candidate drew enough votes to surpass 50 percent threshold of the total votes in the March election. In that March election, the District 5 Board Seat had three candidates competing for the District 5 seat covering the communities of Antioch, Alhambra Valley, Clyde, Crockett, Hercules, Martinez, Mountain View, Pacheco, Pittsburg, Port Costa, and Rodeo – Glover, Kramer and Martinez businessman Sean Trambley – and no candidate had mustered votes exceeding 50 percent of the votes counted. As a result, Glover and Kramer are in a run-off election on November 3.

The Contra Costa County Behavioral Department will operate the county’s Homekey program.

County Assessor Kramer, who must appear in Superior Court Judge John Cope’s court room on today, for a jury trial on civil “corrupt or willful misconduct” charges took a different view on the Board of Supervisors’ action to acquire the 174-room motel from OKC of Pittsburg for use as a homeless facility.

Kramer lashed out at his political opponent Glover and other supervisors for spending $21 million. “It’s a great program, but it is a waste of resources,” he said. “What a horrible investment. Shame on the Board and Federal.”

Kramer did offer a potential solution to the homeless problem in the county and perhaps the state by creating camps like what occurred during the Great Depression where job, health and other public services would also be provided to individuals.

10/27/20 UPDATE: Asked for copies of the appraisal, Chief Assistant County Administrator Eric Angstadt responded, “I’m only aware of one appraisal. It was contracted out. I can give you what the topline is, but the appraisal is not available until after escrow closes.”

“The appraised value is $16.7 million at $96,000 per room,” he stated. “It’s 4.2% above the appraised value.”

Asked if the appraisal was done internally or contracted out, Angstadt said, “We always contract out appraisals. We have staff with real estate licenses. But I don’t believe we have any licensed appraisers on staff.”

“The state was very public about how much they were willing to pay at $100,000 per room,” he continued. “So, it didn’t leave us with much room to negotiate.”

“We have not signed the purchase and sale agreement, yet. That will happen once we finish the due diligence. We are working our way through all of it. It’s scheduled to close escrow on November 10th,” Angstadt added.

Orange COVID-19 Metric Next Week?’

Supervisors were informed that by next Tuesday the county should transition into the orange COVID-19 criteria, Contra Costa County Health Services Director Anna Roth said. “We should meet the orange metric next week,” she said. A move to an orange metric would mean the removal of further restrictions on some businesses.

Since the County declared a State of Emergency because of COVID-19 in March, there have been 18,214 cases and 236 deaths, Roth reported.

The health director encouraged the public to continue to wash hands, keep their distance, and stay home from work or school if they felt ill.

Four Abatement Actions

Supervisors acted on four abatement actions at the recommendations of the Conservation and Development Department.

Properties the Supervisors took action on were:

Property at 2738 Dutch Slough Road, Oakley, owned by Elmo G. Wurts, for $8,141.20; property at 0 Stone Road, Bethel Island, owned by Thanh Ngyyen for $6,964; property at 4603 Gateway Road, Bethel Island, owned by Franks Marina for $5,591.20; and property at 3901 La Colina Road, El Sobrante, owned by Rudolph N. Webbe for $3,256.70.

Supervisors did not hear any comments from either property owners or the public on the abatement items.

Please check back later for any updates to this report.

Allen Payton contributed to this report.

Leaving California or is it time to reinvest in a different property or state? Due to the recent upswing in homes values we have realized a significant growth in equity. Many owners think that they may be stuck in their current investment property. Whether you bought it as an investment, or it was an owner occupied that went past your three-year deferment period you have options. Maybe you would prefer an investment in a different city, region or even another state. Possibly you would like to combine many properties into few or few into many. The answer is a 1031 Tax Exchanges otherwise known as a Starker Exchange. This process allows real estate owners to defer taxes on capital gains resulting from the sale of investment real estate, often a sizable sum since combined Federal and State taxes can run as high as 38 percent.

Leaving California or is it time to reinvest in a different property or state? Due to the recent upswing in homes values we have realized a significant growth in equity. Many owners think that they may be stuck in their current investment property. Whether you bought it as an investment, or it was an owner occupied that went past your three-year deferment period you have options. Maybe you would prefer an investment in a different city, region or even another state. Possibly you would like to combine many properties into few or few into many. The answer is a 1031 Tax Exchanges otherwise known as a Starker Exchange. This process allows real estate owners to defer taxes on capital gains resulting from the sale of investment real estate, often a sizable sum since combined Federal and State taxes can run as high as 38 percent.