Antioch unfunded pension liability more than doubles in four years to almost $160 million

“liabilities with CalPERS are only going to continue to grow even with our contributions.” Council to establish Budget Stabilization Fund with $14.8 million, may form an additional trust fund to cover the liabilities.

By Allen Payton

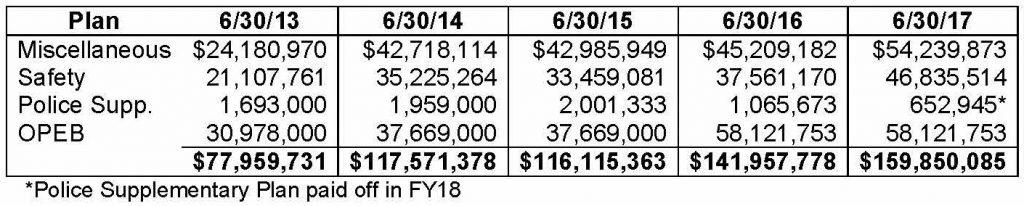

According to the staff report for the mid-year budget review during the Antioch City Council meeting on Tuesday, March 13, 2018, the city’s unfunded pension liabilities more than doubled since 2013 from about $78 million to almost $160 million as of last June 30th.

The staff report on the item reads as follows:

As presented by the City’s independent auditor to the Council on February 13th, the City’s total unfunded liabilities (pension and OPEB) as of 6/30/17 were $159,850,085. This is a figure that keeps exponentially growing due low investment earnings and/or losses and changes in methods, assumptions and actuarial policies by CalPERS. Starting with 6/30/18 financial statements, the OPEB liability will be required to be shown in our financial statements as a liability as well rather than just as a footnote to the financial statements.

Below is a historical snapshot of the City’s unfunded liabilities:

You will notice that the OPEB liability is the same in 2014 and 2015 and then again in 2016 and 2017. Current accounting rules only require a valuation, every two years. However, with the new GASB pronouncement that will require agencies to begin recording the liability on the face of the financial statement beginning with 2017-18, we will be required to get a new valuation annually which will provide an updated liability amount annually.

Since 2013, the City’s total unfunded liabilities have more than doubled from $77,959,731 to $159,850,085 entirely due to CalPERS actions that were unavoidable by the City (or any CalPERS agency). With every payroll, the City contributes to the unfunded liability as required by CalPERS. On a very successful note, during this fiscal year, the City was able to completely eliminate the net pension liability of $652,945 for the Police Supplementary Plan due to the stipulation in the one-time revenue policy that requires the City to apply a minimum of 50% to unfunded liabilities.

The unfortunate side of all of this is that our liabilities with CalPERS are only going to continue to grow even with our contributions. As pointed out to Council by our auditor, CalPERS has reduced the discount rate be applied to plans and with the next valuation the City will use for reporting at 6/30/18, our liabilities will probably increase at least another $25M if not more as this means CalPERS is assuming it will not earn as much money to offset liabilities. We have already been informed by CalPERS that our contribution rates will be increasing significantly over the next several years due to the change in discount rate. As presented to Council last April during the budget workshops, the City’s CalPERS rates are projected to increase just over 7% per year for our Safety Plan and just over 4% per year for our Miscellaneous Plan. However, these projections provided by CalPERS were prior to them adopting a reduced 20-year amortization period for gains and losses on February 14th of this year. This means all agencies will be facing even larger increases in contributions starting in FY22. At this time, CalPERS has not released any projections as to how this will impact contribution rates. Under the current amortization methods in place, the City’s PERS contributions are projected to increase approximately $5.2M between FY20 and FY22.

Section 115 Trust Considered

Section 115 Trust With the pension crisis becoming increasing prevalent across all agencies, the concept of a Section 115 Trust has been introduced as a way to tackle looming costs and historically high unfunded pension liabilities. Council asked for information on a Section 115 Trust.

A Section 115 Trust is an irrevocable trust established to pay for pension obligations. Many agencies throughout California are exploring this option as a way to help fund current and future pension costs. Once established, an agency would select an investment portfolio they feel best meets their objectives and desired return. There are advantages and disadvantages of establishing this type of trust. Providers of the trusts tout the advantage of having a more secure, steady investment stream verses [sic] the large sways PERS has been experiencing; thus building stable income for the portfolio verses significant losses. In addition, the money is secured and set aside for pension payments reducing budget impact for future increases pension costs. Most agencies that have established trusts thus far have significant funds they have been able to set aside. For example, the City of Walnut Creek set aside almost $13M.

Disadvantages of establishing a trust are that per accounting guidelines, any money set aside cannot show as a reduction of the unfunded/net pension liabilities on an agency’s financial statements. Thus, if an agency has $100M in unfunded pension liabilities but has $10M in a trust, the pension liabilities still show at $100M in the financial statements. Another disadvantage to consider is that once a City puts money into the trust, it cannot use it for any other purpose other than pension. Therefore, if an agency has immediate need for money for an unexpected emergency, project, etc. that money is unavailable to use.

Keep in mind that at any time the City can make a lump sum contribution towards our unfunded liability to CalPERS directly which will reduce the unfunded liability. In addition, as mentioned prior, each payroll, a portion of the payment required to be remitted to CalPERS is for the unfunded liability. For OPEB, the City is only required to pay-as-you go to current retirees. There is no mandate to pay beyond that. The City’s one-time revenue policy also requires that a minimum of 50% of one-time revenues be applied to the City’s unfunded liabilities and as mentioned, this policy has allowed the City to eliminate the liability for one of our plans.

Council Agrees to Create Budget Stabilization Fund

The staff report included the following: “At this time, staff recommends using our additional reserves (above the 20% reserve policy minimum) to establish a Budget Stabilization Fund (Stabilization Fund) instead of using any reserves to establish a trust. A Stabilization Fund would allow for setting aside any reserves over 20% in the General Fund into a separate reserve fund. In any year revenues are projected to be lower than expenditures, the Stabilization Fund would supplement the difference, thus reflecting a balanced budget. The Stabilization Fund will help offset any unexpected budget variances, whether it be the result of temperamental revenues, unanticipated projects or projected future increases in CalPERS contributions. The City will have control of how the funds are spent verses the legal constraints of a trust as at the end of the day, the City’s first priority is providing essential services to our citizens on a daily basis and having access to funding to do so. In addition, as Council can see from the chart of the historical liabilities, we are on a runaway train that requires statewide structural modifications to provide realistic sustainable solutions; not just for Antioch but other PERS public agencies that find themselves in much more, dire financial circumstances. However, having the funds to annually meet the required obligations and supplementing with one-time revenues as available is still fiscally prudent and can be accomplished with the Stabilization Fund.

If the City Council were to agree to the establishment of this reserve, there are two options: budget for the full amount of reserves above 20% as of June 30, 2017 to initially establish the fund which equates to $14,872,454 and then establish a policy that in any year that revenues exceed expenditures and reserves are at least 20%, the excess will be placed in the Stabilization Fund and in any year expenditures exceed revenues or the unassigned General Fund reserve falls below 20%, the Stabilization Fund will supplement the General Fund; alternatively, Council can decide on a lower amount to establish the fund and then for any amount of revenue that exceeds expenditures starting with fiscal year 2017-18, that money will be placed in the Stabilization Fund. If the Council should choose the first option, be aware that in this fiscal year the budget and actual will reflect being severally out of balance by an additional $14.8M which may appear shocking, however, it would not be the result of severe overspending, but due to responsible fiscal planning.”

Following the staff presentation by City Finance Director Dawn Merchant, Councilwoman Lori Ogorchock was the first to speak, saying she supported the creation of a Section 115 Trust.

“I understand what you’re saying about a runaway train but, we’re already on it,” she said. “There’s not a problem with having both funds. I’m asking you to put it into an account to make some money off the money.”

Mayor Sean Wright and Councilman Tony Tiscareno didn’t have a problem with creating both.

Tiscareno was concerned “if something catastrophic happens…if we’re hurting for a certain amount of money and we have a pot of funds we can’t use, that’s my concern.”

A consensus of the council was to establish the Stabilization Fund using the $14.8 million from the City’s General Fund reserves. They can also decide later if they want to establish the Section 115 Trust at a later meeting.

the attachments to this post:

The Finance Director and the staff know full well the unfunded amount was never around $78M.

It didn’t just double. The unfunded amount that I have spoken about for years has always been about $120M to $150M. This is not something new, it is something that has been kicked down the road and the day has come when it can no longer be ignored.

This is what happens when you have defined benefit instead of defined contribution.